I. The Origins of Chess: From Battlefield Simulation to Cognitive Discipline

Chess traces its beginnings to 6th-century India, where it was first known as Chaturanga—a simulation of battlefield strategy representing infantry, cavalry, elephants, and chariots (now pawns, knights, bishops, and rooks). As the game spread:

- Persia (Shatranj): The game absorbed formal opening structures and deeper strategic nuance.

- Islamic Golden Age: Scholars like Al-Adli and As-Suli documented systematic chess theory, emphasizing positional play.

- Europe (Medieval to Renaissance): Modern rules evolved—granting queens and bishops expanded movement, increasing game complexity exponentially.

- Soviet Era (20th Century): The USSR institutionalized chess as a cognitive weapon, using it to develop logic, foresight, and national pride.

- 21st Century: Chess became a laboratory for machine learning and AI (Deep Blue, AlphaZero), blending human cognition with advanced algorithms.

Chess has transformed from mere entertainment into one of the world’s most refined cognitive tools—a controlled microcosm of structured infinity.

II. The Shared DNA of Chess, Mathematics & Accounting

Despite their domains appearing different, chess, mathematics, and accounting share foundational DNA:

- All operate within fixed rule structures but allow vast complexity.

- Each demands logical sequencing, forward planning, and error minimization.

- Mastery requires not just knowing the rules, but seeing beyond them into patterns of possibility.

In chess, one miscalculation costs a piece. In mathematics, an error invalidates the entire proof. In accounting, a small misstatement can destroy financial integrity.

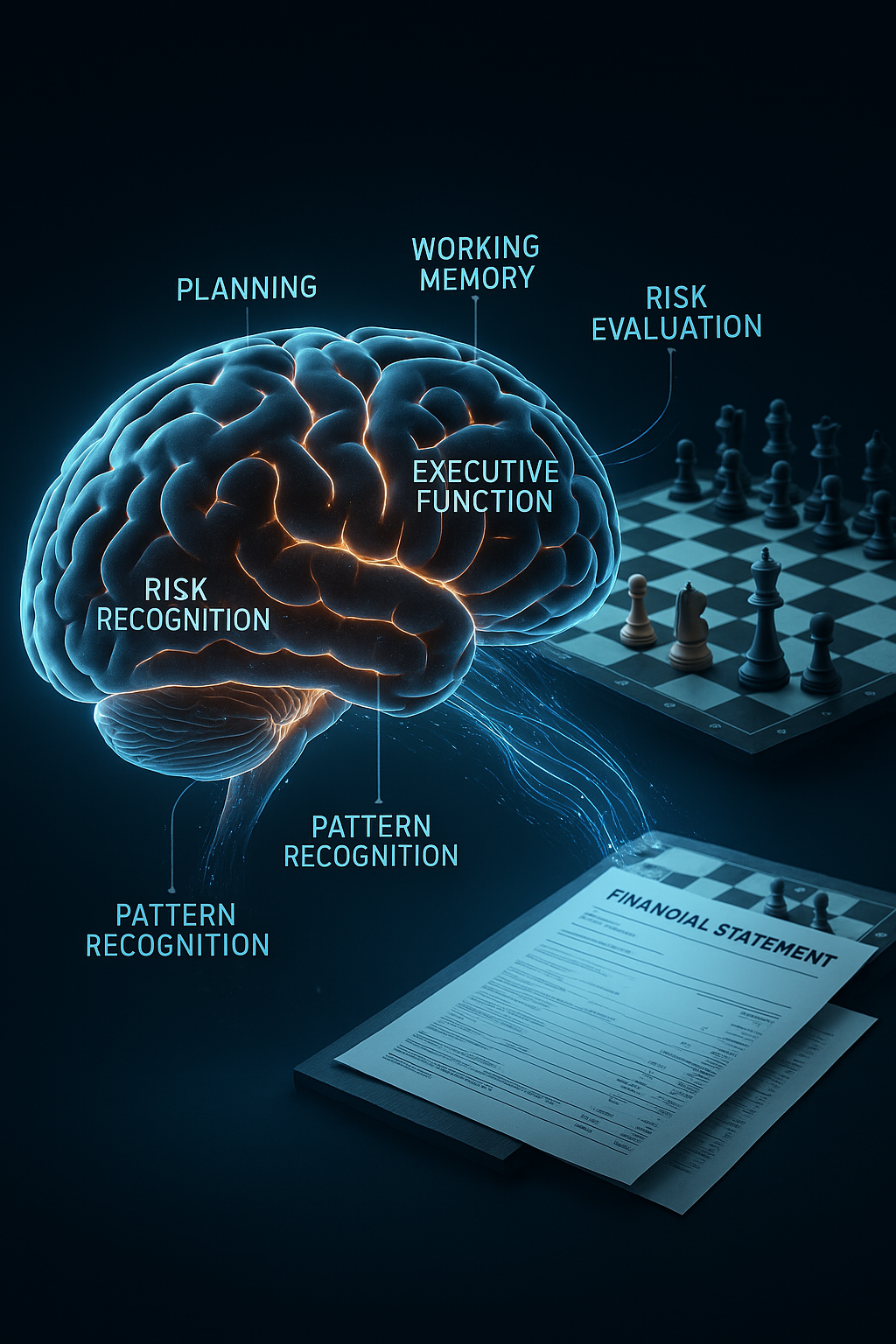

III. Chess as a Cognitive Engine: What Science Says

Multiple medical and cognitive studies have validated chess’s profound impact on brain function:

- A 2020 meta-analysis (Sala & Gobet, 2020) of 24 studies found that chess improves both general cognitive ability and mathematical reasoning with training sessions as short as 25 hours【source: meta-analysis】.

- A 2025 study in Journal of Intelligence demonstrated chess players outperform non-players in planning, risk-taking, delayed gratification, and expected-value decisions【source: Journal of Intelligence 2025】.

- Research published in Frontiers in Psychology shows that intense chess practice reorganizes neural networks—strengthening executive functions while increasing efficiency in working memory【source: Frontiers in Psychology】.

- Longitudinal studies indicate that regular chess play may reduce the risk of cognitive decline by ~9%, suggesting its role as a protective cognitive exercise for professionals working under continuous mental pressure【source: JAMA longitudinal dementia study】.

In short, chess sharpens the very tools that accountants, auditors, and financial analysts deploy daily.

IV. The Accountant’s Chessboard: Where The Professions Converge

Accounting, much like chess, requires a combination of precision and vision. Several technical domains of accounting mirror chess thinking directly:

- Accruals & Prepayments: Accountants must anticipate future financial realities and record them today, just as chess players anticipate future board positions several moves ahead.

- Consolidations: Merging group financials requires simultaneous oversight of both the details and the full picture—akin to playing multiple chess boards simultaneously.

- Provisions & Contingencies: Both disciplines demand recognition of likely future events that may or may not fully materialize, balancing optimism with pragmatism.

- Deferred Taxation: Accountants must constantly forecast timing differences that will resolve years into the future—a chess-like exercise in patience and planning.

An accountant, like a grandmaster, balances certainty with probability, discipline with flexibility, and detail with strategy.

V. Pattern Recognition: The True Shared Core

The silent skill behind chess mastery, mathematical brilliance, and accounting excellence is pattern recognition:

- In chess: forks, pins, tactical motifs.

- In math: algebraic structures, proofs, sequences.

- In accounting: financial statement red flags, fraud signals, profitability patterns, audit risks.

The faster the professional sees the pattern, the faster they stabilize uncertainty.

Both chess and accounting teach the brain to see structures where others see chaos.

VI. Anticipation, Forecasting & Scenario Planning

Chess is a game of multiple futures, much like accounting forecasts:

- Chess demands calculating potential moves many layers deep.

- Accountants forecast cash flows, revenue recognition schedules, and business continuity under uncertain future conditions.

- Both professions reward those who think beyond the present and mentally simulate the most likely future.

The secret is not reaction, but disciplined anticipation.

VII. Emotional Discipline: The Silent Difference

Both chess and accounting also demand emotional control:

- In chess: The impulsive sacrifice often backfires.

- In accounting: Hasty judgments can create regulatory breaches or financial misstatements.

Professionals in both domains succeed not merely through technical competence but through sustained emotional discipline.

VIII. The Algorithmic Age: Chess as a Training Ground for Financial AI

Today’s audit technologies, financial risk algorithms, and forecasting models increasingly replicate chess logic:

- Algorithms calculate multiple financial scenarios, much like chess engines simulate millions of board positions.

- Machine learning models identify accounting anomalies using pattern recognition algorithms derived from game theory and strategic modeling.

Chess has thus trained not only humans but also machines to reason through structured complexity.

IX. Closing Thought

“Both chess and accounting demand that you never play for the present position alone, but always for the future equilibrium that lies ahead. Precision matters—but vision governs.”